Finding Your Operator's Edge: How to Navigate the Lower Middle Market and Land a Premium Exit

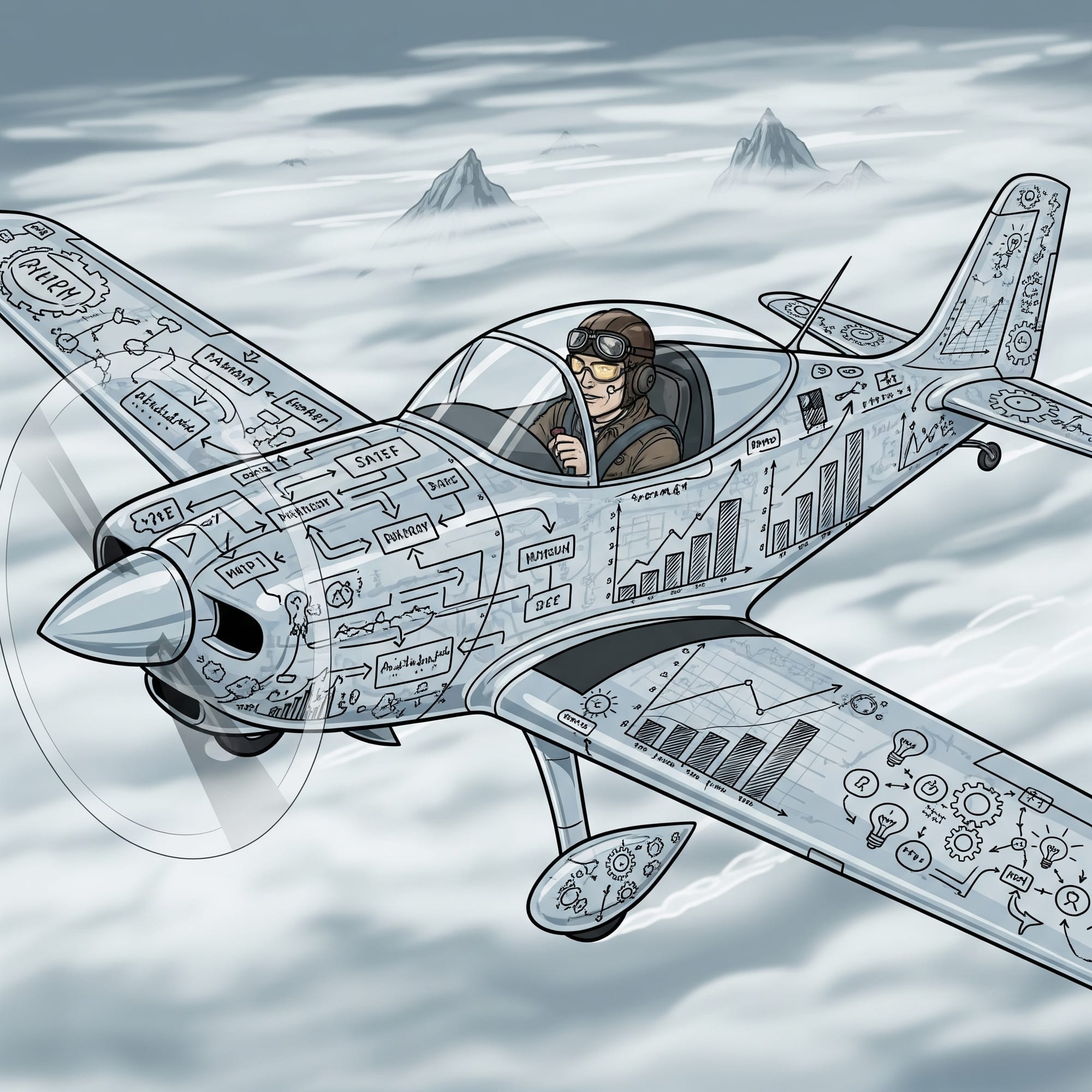

Imagine you're piloting a small aircraft through thick fog. You have no instruments, no co-pilot, and your destination is a place you've never been. To make matters worse, you're building the plane as you fly it. This is the daily reality for a business owner in the lower middle market.

To succeed in this environment, an operator must simultaneously manage daily chaos ("fly the plane"), build scalable systems ("add instruments and expand the fuselage"), and secure the right team and customers ("hire crew and passengers"). Achieving this without crashing requires an "operator's edge"—the invaluable perspective that only comes from experience.

Flying VFR in Unforgiving Skies

The lower middle market, typically defined as businesses with revenues between $5 million and $50 million, is a unique and challenging landscape. These companies are too large to be run on pure grit, yet often too small to have the sophisticated infrastructure of larger corporations. You're flying by sight alone—using Visual Flight Rules (VFR) in skies that are notoriously unpredictable.

This is the "no instruments" problem. Key decisions are often made based on the founder's intuition due to the scarcity of reliable data and reporting. Critical processes exist only as tribal knowledge in the heads of a few key people, not in documented procedures. This reliance on manual effort and gut feel makes the business incredibly vulnerable to sudden market shifts, which can feel like flying into a storm you never saw coming.

Building the Plane in Mid-Air

Surviving in this environment requires an operator to be more than just a pilot; they must also be a mechanic, an engineer, and an air traffic controller, all at once.

First, you have to write the flight manual while flying. This is the paradox of documenting standard operating procedures (SOPs). You know you need them for training, delegation, and creating transferable value, but you're too busy managing crises to stop and write anything down. Yet, without that manual, you can't effectively train a crew or prove to a future buyer that the plane can fly without you at the controls.

Next, you must onboard your crew and passengers. Attracting A-player talent and ideal customers to a plane that looks risky and unproven is a constant struggle. Every hiring decision is critical. A single bad hire or a difficult, resource-draining client can throw off the entire aircraft's "weight and balance," threatening the stability of the enterprise.

While managing all this, you also need to install the instrument panel. Implementing technology like a CRM or ERP system is the equivalent of upgrading from manual stick-and-rudder controls to a modern glass cockpit. It's a necessary and expensive distraction that consumes time and capital, but it's essential for gaining altitude, flying more efficiently, and eventually navigating by instruments instead of by sight.

Finally, you are tasked with expanding the fuselage and wings. Every new service line, market, or major contract is like bolting a new section onto the plane's body mid-flight. This growth fundamentally changes the aerodynamics, requiring more power (capital), a larger crew (team), and more sophisticated controls (systems) to keep it airborne.

The Operator's Edge: Your Co-Pilot and Ground Control

It's nearly impossible to manage these simultaneous challenges without having flown this route before. This is the "operator's edge." It's not a theory learned from a book; it's the muscle memory that comes from experience. This edge can be your own, or it can come from experienced mentors, advisors, or investors who act as your co-pilot and ground control.

An experienced operator can anticipate turbulence, spotting market downturns or internal issues long before they become emergencies. They know which "instrument" to install first to have the biggest impact on safety and performance. Most importantly, they provide a flight plan—a strategic roadmap that turns a reactive, chaotic flight into a purposeful journey toward a clear destination.

The Premium Landing

The ultimate goal is to land the plane successfully through a premium exit. A premium valuation isn't a reward for simply surviving the trip; it's a reflection of the quality of the aircraft you've built along the way. When potential buyers conduct their due diligence, they are performing a pre-flight inspection. They are looking for:

- A documented "flight manual" (strong, clear SOPs).

- A full "instrument panel" (integrated systems and reliable data).

- An experienced "flight crew" (a capable management team that can fly without you).

- A robust "airframe" (a scalable and durable business model).

The alternative—a business that relies solely on the founder's heroics—is a plane only one person can fly. It might land, but its value is severely and permanently limited.

Finding Your Navigator

The journey from a manually-flown small plane to a larger, systems-driven aircraft is the core challenge of the lower middle market. The flight is fraught with peril, and the difference between a rough landing and a premium exit often comes down to the presence of an operator's edge.

So, take a hard look at your own cockpit. Are you flying truly blind? If so, the most critical next step isn't just to work harder on the controls, but to find an experienced co-pilot to help you navigate the path forward.

Click on the button below to book an introductory meeting.