The Mirage of "Dry Powder" in Lower Middle Market Buyouts

In conversations with dozens of business owners over the last three years, one phrase comes up constantly: "There is a record amount of private equity dry powder looking for a home."

While technically true, this statement is a dangerous mirage for sellers and owners of lower middle market (LMM) companies.

The headlines may boast of trillions in unspent capital, but the reality on the ground is starkly different. The vast majority of that capital resides in mega-funds that are structurally unable to write the smaller equity checks required for LMM buyouts (i.e., businesses with an enterprise value under $100 million).

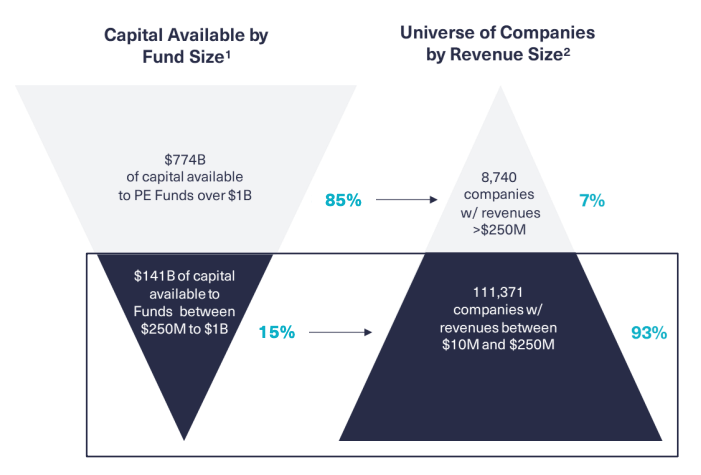

This imbalance is perfectly captured in the graph below from RCP Advisors’ excellent research, "The Case for Small Buyouts."

As the data clearly shows, a staggering 85% of available capital ($774B) is held by PE funds over $1B. Yet, this mountain of cash is chasing a tiny sliver of the market—just 7% of companies (those with revenues over $250M).

Conversely, the real engine of our economy—the 111,000+ companies with revenues between $10M and $250M—is being pursued by only 15% of the available capital.

This "capital illusion" creates a massive expectations gap. Sellers, hearing tales of abundant capital, hold out for valuations their businesses cannot support. Deals stall. Great, family-owned businesses fail to transition, with some owners even in their 80s and 90s still waiting for a mega-fund payday that will never materialize.

The opportunity for a successful sale doesn't lie in chasing that mirage. It lies in understanding the reality: the capital available for the lower middle market is disciplined, strategic, and wielded by partners who create value through operational expertise, not financial engineering.

At Backer North Investments, our approach is grounded in this reality. A successful transaction requires aligning with a partner who understands your market, respects your legacy, and proposes a reasonable valuation that allows for shared success post-close. It's not about finding the biggest pile of cash; it's about finding the right partner.

Click on the button below to book an introductory meeting.